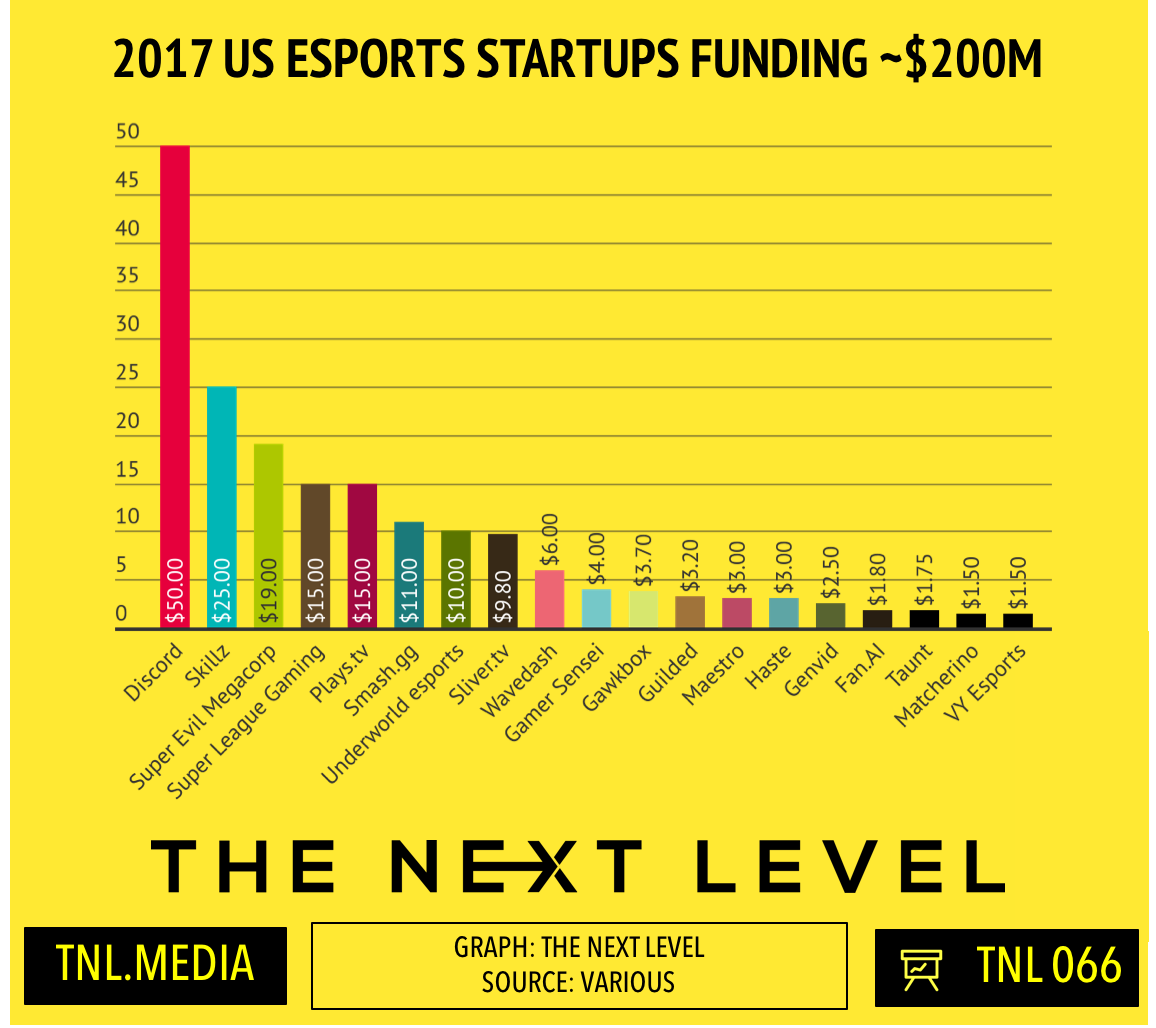

TNL Take: Esports One recently announced a $3M seed round co-led by XSeed Capital and Eniac Ventures, with participation from Crest Capital.

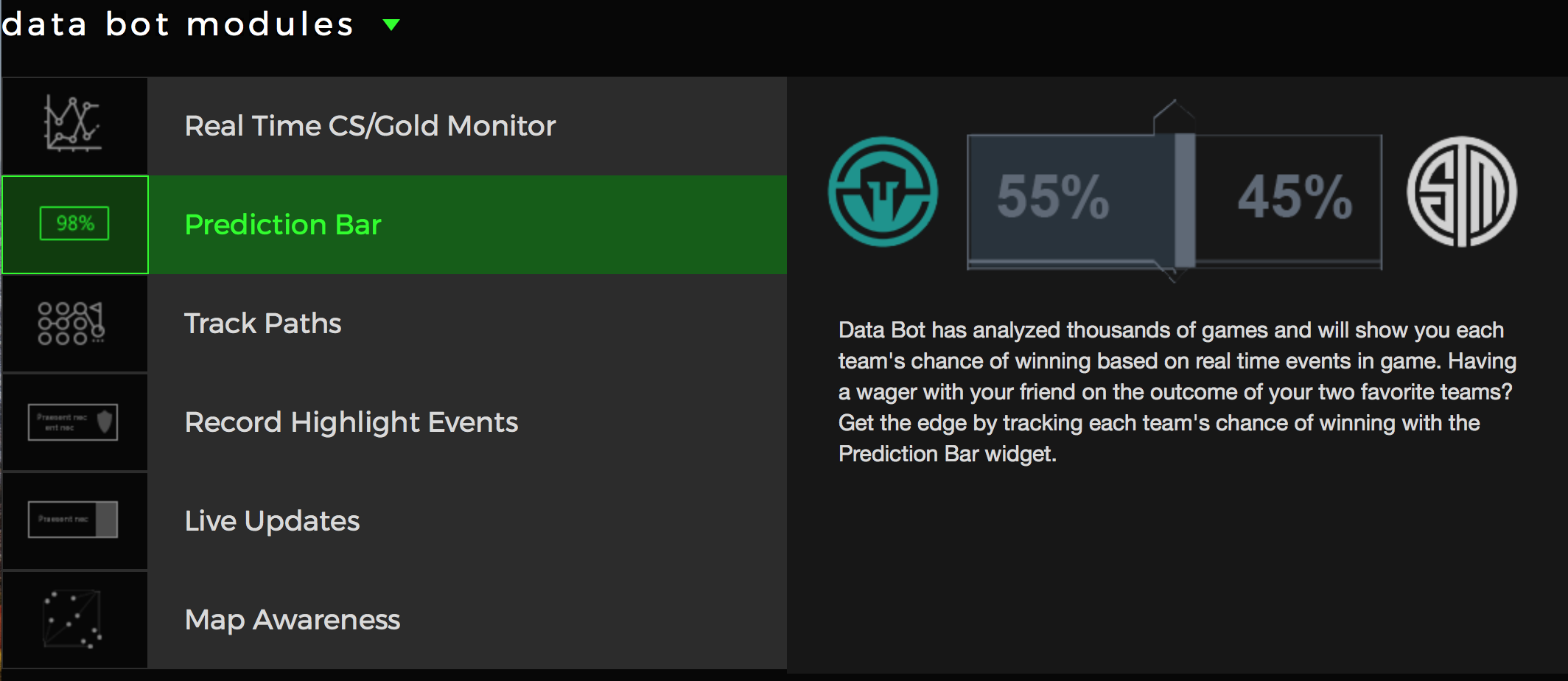

Esports One utilizes "proprietary computer vision technology, machine learning and custom datasets to provide real-time, live modules to inform and engage any esports fan" as seen below.

The only hot buzzword not included in that description would be cryptocurrency - but maybe an ICO is in the future.

The Next Level spoke with CEO Matthew Gunnin to get further insight into what this really means for the industry.

What was the original challenge you set out to solve with Esports One?

Previously to founding Esports One, I worked at Azubu as Director of Content and then Unikrn as VP of Product. During my time at these companies, I came to realize what I believed was one of the biggest gaps in the industry: The lack of real-time data, non-existent viewer customization and more engaging broadcaster tools. Our mission at Esports One is simple, we want to enhance the esports viewing experience for fans around the world.

Esports One contains "proprietary computer vision technology, machine learning and custom datasets” - which sounds almost like the Terminator. What’s this mean in the simplest terms?

In simple terms, it means that we capture what’s happening on an esports stream in real-time (the computer vision aspect), analyze what was just captured (the machine learning aspect), compare what was captured against our databases of historical information (the custom datasets aspect) and then present this information to the viewer. This final product, the information, can be shown to the viewer in a number of ways. If a broadcaster is utilizing the Esports One platform, this information would be integrated live into the stream, similar to the stats and information you see when watching Football or any other traditional sport. If a viewer chooses to watch a stream on the Esports One site, they will have fully customizable “modules” that will surround the stream with whatever information they wish to see.

You’ve currently launched on Twitch and have integrated into their Extensions platform. What examples can you provide of the value to the viewer?

The extensions platform allow for an endless number of integrations with Esports One. Being able to provide broadcasters with new ways of engaging with their audience through the use of computer vision and motion tracking is a core principle of Esports One.

Whether that’s in the form of mapping out a players jungle movements through the course of a game, highlighting skill combinations and gold per minute graphs by the second or providing the viewers with a live prediction bar of the expected outcome and showcasing each event as it affects the percentages.

What if tournament organizers could provide their viewers with the ability to dig into a players team history and statistical breakdown all without leaving the stream. Maybe you want to know a players win percentage as soon as they pick a champion. And these are just a few of the features we will have available at release.

Where else do you see Esports One heading?

We see card games and real time strategy as an easy expansion point for Esports One and have already began to work on prototypes that bring value to the genres. FPS, including Overwatch and Counterstrike are obvious expansion points and it starts with determining what the core areas that we feel need to be addressed within each game. Right now though we are focused on releasing our League of Legends product first while we expect to begin expansion into other game titles by early Q2 of this year.

How does Esports One plan to monetize?

We’re approaching monetization from two sides.

We’re actively developing tools that will allow event broadcasters to integrate the Esports One platform directly into their production environment and thus increase the quality of their streams. We will license out each product for use, all the while establishing our core stats and data warehouse. Our consumer platform will provide users with the ability to view and engage with live esports content like never before.

As the platform grows, we will begin to introduce premium features for fans that prefer more control of their experience. For example, being able to know how many times a player has picked a specific champion vs. their win rate on that champion after losing the first match of a best of 3 while playing during a winter snowstorm after traveling more than 500 miles on a Sunday afternoon.

Something like that.

Thanks for your time Matthew.